Category Global Economy

Guest post: Russia, Left in the Ruble

by Mike Azar With the Russian currency (the ruble) plummeting and borrowing costs shooting higher, Russia is on the edge of a full-blown financial crisis. In the last three months, the ruble has lost nearly 50 percent of its value against the dollar, as the price of Brent crude oil (a key oil price benchmark) […]

Inflation: Slowly Rising Prices Can Be a Bad Thing

It is important that prices don’t rise too fast when times are good or too slow when times are bad. The latter is the current situation in some key advanced economies, with low and falling inflation emerging as the most serious obstacle for a return to full employment and a durable economic recovery. Weak demand […]

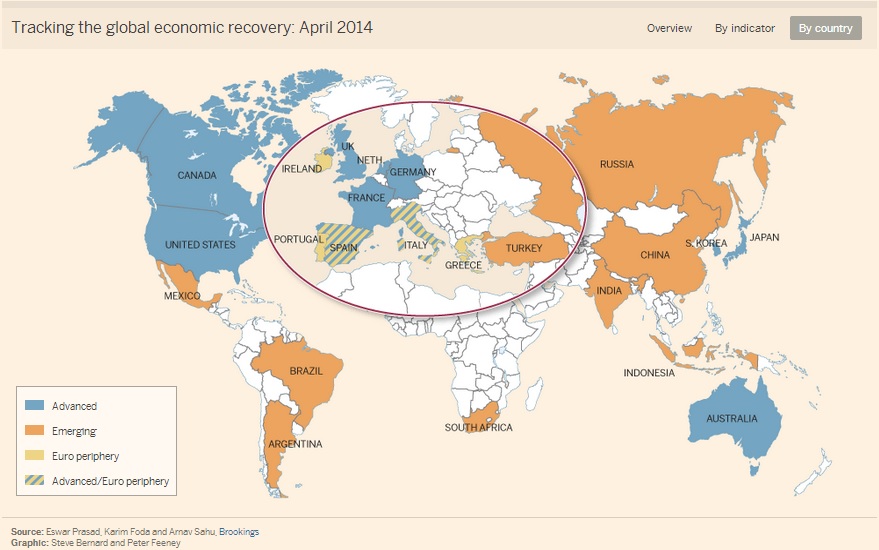

Tiger Index: A Shaky Recovery Runs Out of Steam

This article originally appears on the Financial Times website to accompany the Brookings-FT Tracking Indices for the Global Economic Recovery (TIGER). To view a full set of charts, visit the Financial Times or Brookings. By Eswar Prasad, Karim Foda, and Arnav Sahu The global economic recovery has stalled and become unbalanced, with the U.S. now […]

Is China Serious About Liberalizing the Renminbi?

**This article originally appears here in the Financial Times online blog ‘Beyondbrics’ and refers to the interactive China Currency Tracker. Both are featured in the Financial Times Special Report: The Future of the Renminbi.** By Eswar Prasad, Karim Foda, and Abhinav Rangarajan September 30, 2014 China is making steady progress on its path to making the renminbi an […]

China Is Not On Top, Yet

For the first time in history, the largest economy in the world will be poor. Last week, the World Bank revealed that prices in developing countries are much lower than we previously thought, implying that the purchasing power of citizens in those countries is stronger. Taking this into account, new estimates of GDP at purchasing […]

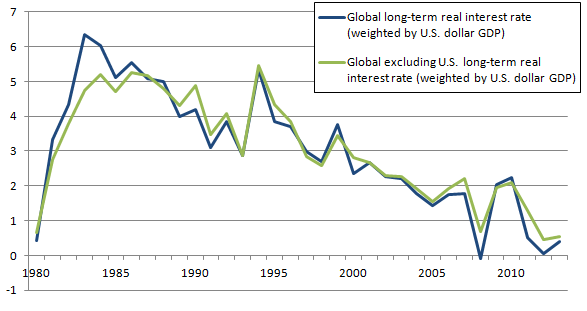

Of Global Interest

The persistent decline of global real interest rates since the 1980’s has been puzzling. Public debt in advanced economies is approaching record highs, yet borrowing costs have continued to decline. The good news is that a low interest rate improves fiscal sustainability for governments trying to improve their fiscal positions. The bad news is that […]

Tiger index: Better Days Could be Ahead

This article originally appears on the Financial Times website to accompany the Brookings-FT Tracking Indices for the Global Economic Recovery (TIGER). To view full set of charts, see http://www.ft.com/tiger or http://www.brookings.edu/tiger By Eswar Prasad, Karim Foda and Arnav Sahu The global economic recovery remains uneven and wobbly but finally appears to have built up […]

(un)Employment in the U.S.

The unemployment rate in the U.S. has been steadily declining since it hit 10 percent in October 2009. Four and a half years of steady and consistent improvement in the unemployment rate, however, has convinced neither policymakers nor the public that the American labor market is on track for a comeback. At the end of […]

Driving Growth to Catch Up

Any casual observer of the world’s state of affairs knows that advanced economies have been in trouble and emerging markets and China in particular have been important drivers of global economic growth. Despite concerns of “emerging market turmoil” over the last couple months, there has been a sense of unease and fear in advanced economies […]

Global Burden of Disease

A healthy population is a productive one. Disease, malnutrition, sanitation and other public health concerns are central to the development of a region and to the productive capacity of a population. With the advancement of technology, increased availability of drugs and improved governance, death by communicable disease has decreased and average life expectancy globally has increased […]

Call It A Comeback: Egypt’s Economy

Egypt’s democracy. Egypt’s politics. Egypt’s economy. As mainstream popular reaction in the West suggests, the essence of democracy is the vote. As mainstream popular reaction in Egypt itself suggests, the essence of democracy is liberty. Ultimately, the essence of a free and prosperous society is an inclusive political system and an inclusive economy that provides […]

Rates of Interest at the ECB

Today, the European Central Bank (ECB) announced a cut in the interest rate that it charges when it lends money to commercial financial institutions like banks. With falling inflation (a signal of a sluggish economy when extra low) and record high unemployment in the eurozone, this drop in the refinancing rate, from 0.75 percent of […]

Hopes Lift as Europe Shifts

Europe is finally shifting its priority from fiscal austerity to growth. After a few years of harsh spending cuts, eurozone-wide budget deficits fell from a peak of 7 percent in the third quarter of 2010 to below 4 percent at the end of 2012. During that same time, growth went from positive to negative and […]

Buying Time by Buying Bonds

Note: This article originally appears at and belongs to The Brookings Institution. By Kemal Derviş, Galip Kemal Özhan and Karim Foda On Thursday, European Central Bank President Mario Draghi outlined a framework for a bond buying program to stabilize financial markets as policymakers tackle the underlying national and eurozone structural reforms that are necessary to […]

Euro Area Saved – For a Short Moment

Today, markets rallied. Financial markets around the world let loose a big sigh of relief as the President of European Central Bank (ECB), Mario Draghi, said today at a conference in London that he is ready to do “whatever it takes” to support the euro. People have been wondering whether or not the ECB would do […]

A Vicious Cycle in the Euro Area

One day, markets are up immediately after some EU summit but back down again just hours later. Another day, Spain asks for a bailout because its banks have reached the point where they might fail, all while Greek voters are hitting the streets to protest drastic spending cuts and austerity measures that are meant to […]

The Monetary Union and Its Survival

As members of a monetary union, stronger economies have an interest in keeping the problems in the weaker economies from spreading and affecting the rest of the union. Therefore, there is a common stake at making sure each country is meeting its obligations and doing the best it can to support its economy. A common […]

The Geography of the Euro Crisis

Much of the high sovereign debt in many euro area countries are direct results of policies that led to high spending in the years before the financial crisis hit in late 2008 (like Greece, Portugal, and to an extent Italy), but in other cases are results of excessive lending by private banks into the real […]