It is important that prices don’t rise too fast when times are good or too slow when times are bad. The latter is the current situation in some key advanced economies, with low and falling inflation emerging as the most serious obstacle for a return to full employment and a durable economic recovery.

Weak demand and employment, heightened perceptions of risk, and falling energy prices have all helped to push inflation lower and expectations for future inflation lower as well. This has many eyes at central banks, governments, businesses, and households watching with great concern because very low inflation and the threat of deflation (falling prices) can imply greater unemployment, slower growth or recession, and higher real debt – the latter being especially worrisome for financially stressed countries.

Understanding the risks

It may be straightforward to see that rapidly rising prices are bad for consumers if their incomes don’t grow at least as fast, and bad for businesses as costs rise and revenues potentially fall[1]. It may not be as straightforward to see that when prices rise very slowly or even fall when growth is low, it becomes harder and harder for employment and income to recover.

There are a few key reasons. Declining inflation and fears of deflation stymies business investment because it increases the risk that the value of money made tomorrow could be worth less than money today. It weakens consumption demand as goods bought tomorrow could end up being cheaper than goods bought today. Even if the threat of deflation is not acute, very low inflation provides little incentive to buy now instead of later to get a better deal, keeping demand suppressed. The drop in investment and consumption keeps firms from hiring more workers and compels them to lay off workers if business is low, especially since wages take time to adjust. In other words, sticky wages make it harder for a firm to adjust its costs in line with economic conditions, compelling to lay off workers in order to weather the slowdown in business.

If levels of government or household debt are already high, low inflation would make it harder to pay that debt, especially since it also stalls wage and income growth. Low inflation stalls wages, income, and tax revenues, making it more difficult for households, businesses and governments to pay their debts. Deflation would push wages, income, and tax revenues down, making it even more difficult to pay down debts that increase in value when inflation turns to deflation. Both situations could trigger further concerns if lenders become concerned that borrowers can’t pay them back. See A Vicious Cycle in the Euro Area.

A central bank mandate

The mandate of any central bank is to manage the level of inflation in an economy based on its assessment of underlying economic conditions. Many central banks, like the Federal Reserve, have a dual mandate of inflation and employment, where price stability and full employment are its objectives. To keep inflation close to a central bank’s target inflation rate, it would typically lower interest rates in an attempt to restore demand and encourage spending. Today, interest rates are already close to zero across advanced economies and cannot go any further in real (inflation-adjusted) terms, limiting the options central banks have to combat low inflation. Given the current political environment in these economies, the prospects for fiscal policies that could help stimulate spending and push up inflation in the short-term are dim.

The channels to combat the threat that low inflation poses to employment and growth are therefore constrained, adding uncertainty as to how central banks could achieve the inflation targets. The European Central Bank (ECB), Bank of England, and Federal Reserve all have inflation targets of 2 percent, and each central bank is currently under their targets with inflation rates at 0.3, 1.3 and 1.7 percent, respectively.

The situation is much more dire in the Eurozone. Accounting for a fifth of global income and a quarter of global trade, prolonged economic malaise in the Eurozone is bad news for an already struggling global economy.

Declining inflation in the Eurozone and the US

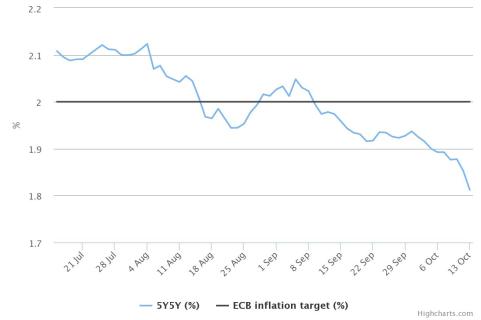

In the Eurozone, low inflation and the threat of deflation is significant and arguably the single largest threat to a badly needed economic recovery to bring unemployment down from a recent record high of 12 percent. The ECB recently began a program that is in a way similar to the Federal Reserve’s quantitative easing (QE) programs, where the ECB would directly buy certain bonds and assets within the Eurozone to help provide a type of stimulus to help speed up inflation rates. Despite these steps taken by the ECB so far (and President Mario Draghi has announced they intend to do more), expectations for future inflation in the Eurozone are still falling and for the first time in 15 years have fallen below 2 percent, currently at 1.84 percent[2]. Whether or not QE in the Eurozone would work to lift inflation is a current debate, but it is agreed that quick and decisive action is necessary or else the Eurozone could be at risk for much longer, deeper, and more lackluster recovery period, as had happened in Japan in the 1990s.

The experiences of Japan with low inflation, deflation, and low growth for over a decade show that it is crucial for policymakers to act quickly and preemptively or risk low inflation becoming deflation. Japan’s experiences also show how rigid long-run expectations are and once destabilized, may move irreversibly down.

Inflation Expectations In the Eurozone

Source: The Telegraph.

Note: 5-years in 5-years forward swap rate.

In the US, after 5 years of quantitative easing that pumped close to $4 trillion into the economy, inflation remains below the Fed’s 2 percent target and expectations have recently declined. The threat of deflation in the US is currently not serious unlike the Eurozone, and the US labor market has been steadily improving. The recent forces driving inflation down in the US – falling global energy and commodity prices, and a strengthening dollar – are attributed by some to be temporary. If the falling energy and commodity prices signal a decline in global economic activity, however, the threat could become stronger.

In summary

In a period of low growth and high unemployment, low inflation and the threat of deflation are particularly important issues that can counter meaningful economic progress. These risks are being faced, in varying degrees, across some key advanced economies. The problem is especially acute in the Eurozone, prompting the ECB to take fast and decisive action. The kinds of actions it must take characterize the most serious economic policy debate in the Eurozone today. Proposals to address this problem are naturally rooted in the causes – Why is inflation so low, after all? This will be the next topic of discussion here at the Record, so stay tuned.

Ultimately, the responsibility of price stability lies with central banks. The sooner politicians can reach compromises on important economic reforms that only legislatures and governments can enact, the less pressure there would be on monetary policy overall. This is the case across many advanced economies. The last few decades have had many episodes of damaging high inflation, yet it is now up to policymakers to address the threats of damaging low inflation. Let’s hope that central banks secure their credibility by reaching their inflation targets – it is in our collective interest.

FOOTNOTES:

[1] If prices rise for a single good, people tend to buy less of that good, but may end up paying the same or even more than they were before (value vs. volume). This depends on how much a consumer needs the good in question.

[2] Based on 5-years in 5-years forward swap rate, the main measure the ECB uses for inflation expectations.

[…] un dólar más fuerte y precios de energía más bajos— están sirviendo para mantener unos niveles de inflación por debajo de lo esperado. Lo cual, a su vez, puede implicar un mayor desempleo, un crecimiento más lento y una mayor deuda […]

[…] – a weaker world economy, stronger dollar and lower energy prices – are serving to keep inflation subdued longer than expected. As global factors are pushing inflation down for the time being, the Fed has […]

[…] target of 2 percent and is headed lower along with expectations of future inflation. As discussed previously on the Record, low inflation can be problematic because it places downward pressure on both consumption and […]

whoah his blog is wonderful i like reading your posts.

Stay up the great work! You understand, lots of persons are looking round for this information, yoou could aidd them greatly.

Thank you, I am glad you find the posts here useful. You can receive an email every time there is a new post. Just submit your email in the homepage and with one click you can stay updated. Many thanks from the Record.